Essentials of Investments 12th Edition PDF provides a comprehensive overview of the fundamental principles and practices of investing. It explores the different types of investments, financial markets, risk and return analysis, investment analysis and valuation, investment management and portfolio construction, and ethical and sustainable investing.

This guide offers valuable insights for both novice and experienced investors seeking to make informed investment decisions.

Overview of Investment Essentials

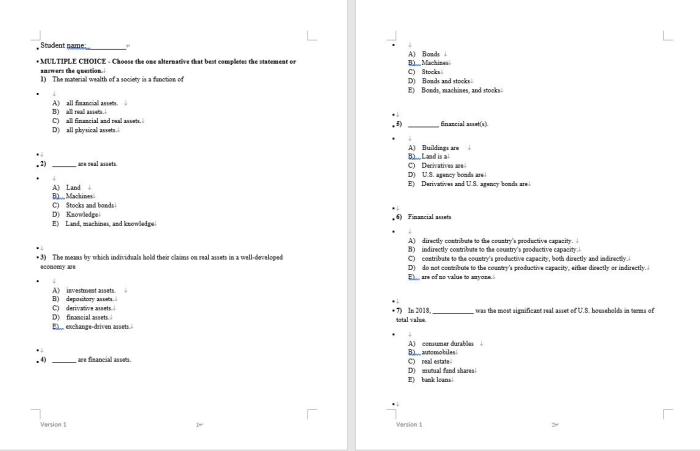

Investing is the process of allocating money with the goal of generating future financial returns. The fundamental principles of investing involve understanding the different types of investments, their characteristics, and the potential risks and rewards associated with each.

Common investment strategies include diversification, asset allocation, and risk management. Diversification involves spreading investments across different asset classes to reduce risk, while asset allocation refers to the distribution of investments based on the investor’s risk tolerance and financial goals. Risk management techniques aim to minimize the potential losses associated with investments.

Types of Investments

- Stocks: Represent ownership in a company and can provide potential returns through capital appreciation and dividends.

- Bonds: Debt securities that pay fixed interest payments and return the principal at maturity.

- Mutual funds: Pooled investments that offer diversification and professional management.

- Exchange-traded funds (ETFs): Baskets of securities that track a specific index or sector, providing instant diversification.

- Real estate: Physical property that can generate rental income and potential appreciation.

Understanding Financial Markets: Essentials Of Investments 12th Edition Pdf

Financial markets are platforms where buyers and sellers of financial instruments interact to determine prices and facilitate transactions. The structure of financial markets includes primary markets, where new securities are issued, and secondary markets, where existing securities are traded.

Functions of Financial Markets, Essentials of investments 12th edition pdf

- Capital formation: Financial markets allow businesses and governments to raise capital by issuing securities.

- Liquidity: Financial markets provide liquidity to investors by enabling them to buy and sell securities easily.

- Price discovery: Financial markets determine the prices of securities based on supply and demand, reflecting their intrinsic value.

Market Participants

- Issuers: Entities that issue securities to raise capital.

- Investors: Individuals or institutions that purchase securities to generate returns.

- Intermediaries: Brokers, dealers, and investment banks that facilitate transactions between issuers and investors.

- Regulators: Government agencies that oversee financial markets to protect investors and ensure fair play.

Risk and Return Analysis

Risk is the potential for losses associated with an investment, while return is the potential for gains. The relationship between risk and return is typically positive, meaning higher potential returns come with higher risks.

Measuring Investment Risk

- Standard deviation: Measures the volatility of an investment’s returns.

- Beta: Measures the sensitivity of an investment’s returns to market fluctuations.

- Value at risk (VaR): Estimates the maximum potential loss over a given period with a specified confidence level.

Managing Investment Risk

- Diversification: Spreading investments across different asset classes and investments.

- Hedging: Using financial instruments to offset potential losses from other investments.

- Asset allocation: Adjusting the proportions of different asset classes in an investment portfolio based on risk tolerance.

FAQ Resource

What are the key principles of investing?

The key principles of investing include diversification, asset allocation, and risk management.

How can I measure investment risk?

Investment risk can be measured using various methods, such as standard deviation, beta, and the Sharpe ratio.

What are the different types of investment strategies?

There are numerous investment strategies, including value investing, growth investing, income investing, and momentum investing.