The journal entry to record employer payroll taxes affects not only the financial statements but also the compliance and accuracy of payroll tax reporting. This comprehensive analysis delves into the components, timing, and internal controls associated with payroll taxes, providing a clear understanding of their significance in payroll processing.

As employers navigate the complexities of payroll tax obligations, this exploration unravels the impact of the journal entry on employer payroll taxes, shedding light on the changes in financial statements and the consequences of late or incorrect payments.

Effects of Journal Entry on Employer Payroll Taxes: The Journal Entry To Record Employer Payroll Taxes Affects

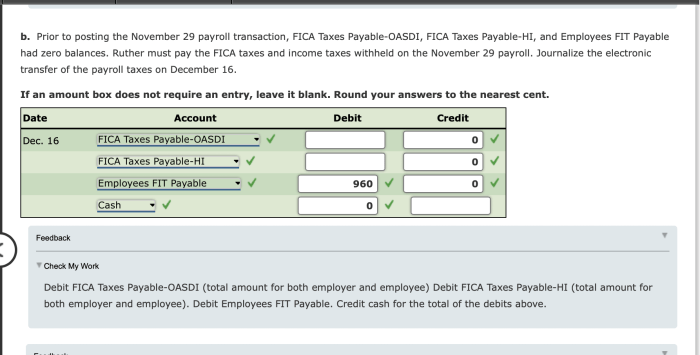

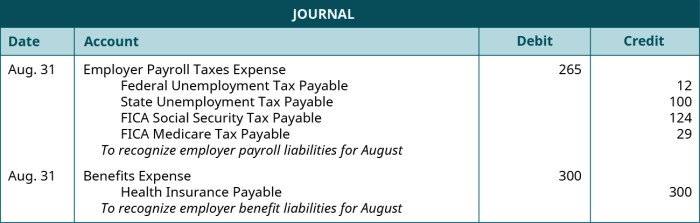

The journal entry to record employer payroll taxes affects the financial statements in several ways:

- Increases the expense account for payroll taxes.

- Decreases the cash account for the amount of taxes withheld from employees.

- Increases the liability account for payroll taxes payable to the government.

Components of Payroll Taxes, The journal entry to record employer payroll taxes affects

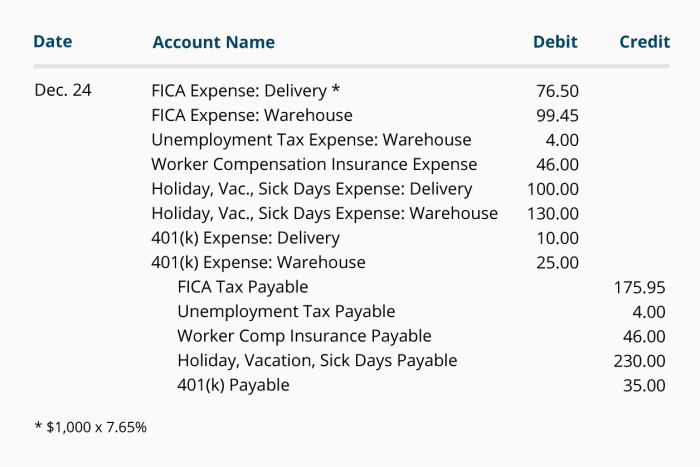

Payroll taxes include:

- Federal income tax: Withheld from employees’ wages based on their income and filing status.

- Federal Social Security tax: Contributed by both employees and employers to fund retirement and disability benefits.

- Federal Medicare tax: Contributed by both employees and employers to fund healthcare for the elderly.

- State income tax (if applicable): Withheld from employees’ wages based on their state of residence.

- State unemployment tax (if applicable): Contributed by employers to fund unemployment benefits for former employees.

Timing of Payroll Tax Payments

Payroll taxes must be remitted to the government on a regular basis, typically monthly or quarterly. The deadlines vary depending on the type of tax and the size of the employer. Late or incorrect payments can result in penalties and interest charges.

Reconciliation of Payroll Tax Accounts

Payroll tax accounts should be reconciled regularly with the corresponding tax authorities to ensure accuracy and compliance. This involves comparing the amounts withheld and paid to the amounts reported on tax returns.

Internal Controls for Payroll Taxes

Strong internal controls are essential for ensuring the accuracy and compliance of payroll tax reporting. Key controls include:

- Segregation of duties: Different employees should be responsible for recording payroll transactions, reconciling accounts, and remitting taxes.

- Authorization and review: Payroll transactions should be authorized by a responsible employee and reviewed for accuracy before being processed.

- Documentation and record-keeping: Payroll records should be maintained for a specified period of time and should be easily accessible for audit purposes.

FAQ Insights

What is the impact of the journal entry on employer payroll taxes?

The journal entry records the employer’s liability for payroll taxes, affecting the financial statements by reducing the company’s net income and increasing its payroll tax expense.

What are the different types of payroll taxes included in the journal entry?

Payroll taxes typically include federal income tax, Social Security tax, Medicare tax, and state and local income taxes, if applicable.

What are the key internal controls for ensuring the accuracy and compliance of payroll tax reporting?

Internal controls include proper authorization of payroll, accurate calculation of taxes, timely remittance of payments, and regular reconciliation of payroll tax accounts.